Lumina Intelligence Functional Foods Without the Hype: What Consumers Want

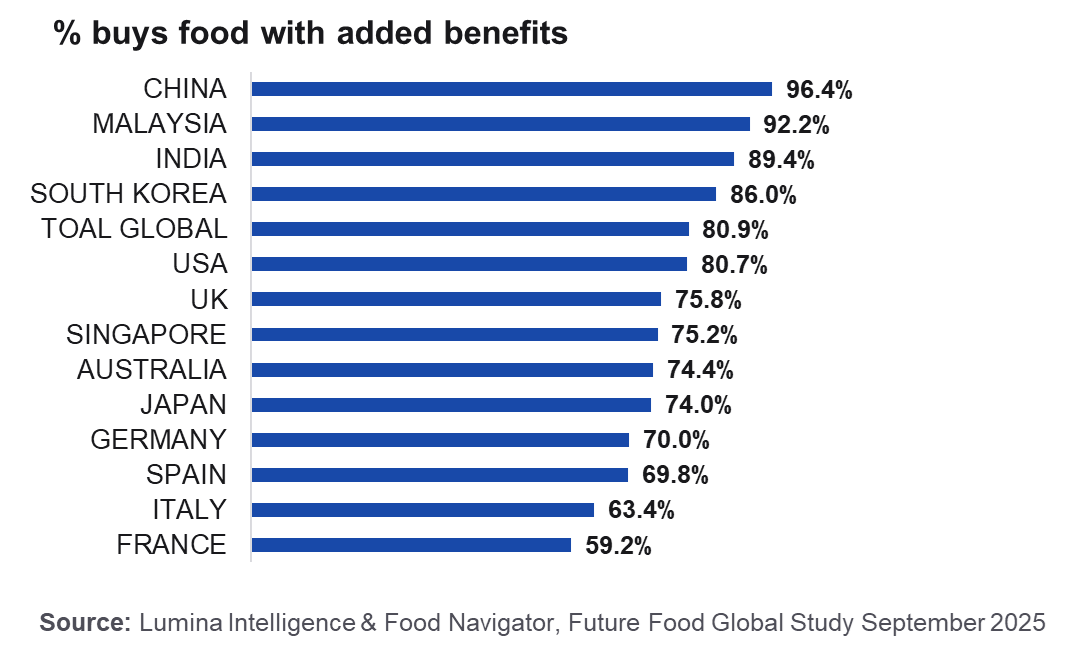

Functional foods are no longer a niche segment. Globally, four in five consumers now buy foods with added benefits, underlining how deeply functionality is embedded in everyday purchasing behaviour.

However, rising adoption has not translated into blanket enthusiasm. As functional foods become more commonplace, consumer expectations are sharpening. The challenge for brands is no longer whether to add functionality, but which benefits genuinely matter, how they are communicated, and where they fit naturally within diets.

Our latest nutrition data shows that added benefits drive purchase but only when they align with real health goals, cultural context and taste expectations.

Why functional foods have become a core part of modern diets

Health goals are increasingly shaping shopping behaviour. Across markets, consumers understand a healthy diet more in terms of what is added rather than what is restricted, signalling strong alignment with functional nutrition formats.

Functional foods are not primarily driven by aspirational wellness, but by everyday lifestyle pressures: sleep deprivation, energy management, immunity concerns and weight control. These pressures vary by region, but the result is consistent, functionality is now expected across everyday categories rather than reserved for specialist products.

What consumers mean by “functional nutrition”

For consumers, functional nutrition is overwhelmingly associated with added benefits, not restriction or avoidance.

Ingredients such as vitamins, minerals, protein, fibre, probiotics and omega-3s dominate awareness and purchasing behaviour.

Notably, functional does not imply “high-tech” or unfamiliar. The most widely purchased functional ingredients are those consumers already understand, while more novel ingredients (such as adaptogens, nootropics and functional mushrooms) remain niche but are gaining traction in specific markets.

Our data shows that consumers are most responsive to functional benefits they already understand, such as protein, vitamins and gut health, while unfamiliar or complex functionality faces greater scepticism.

The functional benefits consumers prioritise most

Protein is the top added benefit globally and remains the dominant functional driver in Western markets, particularly the UK, US and Australia.

Its strength lies in versatility: protein is linked to satiety, muscle maintenance, fitness, energy and general health, making it broadly relevant across demographics and categories.

Beyond protein, global functional food consumer trends show a clear hierarchy of added benefits centred on everyday health maintenance rather than niche optimisation.

Gut health, immunity and energy as supporting benefits

Gut health and immune support emerge as the next tier of functional benefits, with particularly strong resonance in Spain, South Korea, China and India, where these benefits also align closely with stated health goals.

Energy and focus play a secondary but meaningful role, especially in high-pressure work cultures and urban markets.

Weight management and appetite-related benefits

Weight management remains a recognised but minority functional benefit, with around one in ten consumers purchasing foods positioned around appetite control or weight support.

Healthier weight was the 8th most mentioned goal in our recent nutrition report yet was the third most likely to be ranked first, indicating that for those where it is a goal, it is a top priority.

Where functional food demand differs by market

- Asian markets – Asian markets show above-average engagement with functional ingredients, particularly in China, India, Malaysia and South Korea. Cultural familiarity with functional ingredients, including mushrooms, adaptogens and herbal formats, supports stronger acceptance and experimentation.

- Western markets – In Western markets, functional foods are closely tied to protein, performance, fitness and convenience. Adoption is high, but benefits must feel purposeful rather than excessive, with protein-led propositions continuing to outperform.

- Southern & Continental Europe – France and Italy stand out for lower demand for added benefits, reflecting strong culinary traditions, high confidence in diet quality and a preference for fresh, minimally processed food.

Here, overt functionalisation can trigger scepticism, particularly when it appears to compensate for processing.

The limits of functionalisation: what consumers reject

While consumers are open to functional benefits, taste and texture remain non-negotiable. Data shows that consumers are willing to compromise on convenience, shelf life and even price but not on eating enjoyment.

Over-engineered products, excessive claims or benefits that feel unnecessary risk disengagement, particularly in mature functional markets.

Trust, understanding and functional food credibility

More than 60% of consumers read ingredient lists, yet far fewer say they fully understand them, creating a knowledge gap that can undermine trust.

Clear labelling, simple benefit framing and education are critical to maintaining confidence in functional claims especially as scepticism toward processing increases.

What this means for functional food strategy

The data makes clear that “adding everything” is not a winning strategy. Successful functional foods are built on:

- Clear benefit relevance

- Alignment with local health priorities

- Cultural and market context

- Simple, credible communication

Functional foods perform best when positioned as precision solutions, not blanket health upgrades.

Functional foods succeed when relevance beats novelty

Functional foods are firmly embedded in global diets, but success depends on relevance rather than novelty. Consumers reward brands that align functional benefits with genuine needs, deliver on taste, and communicate clearly.

In an increasingly crowded functional landscape, data-led insight is the defining competitive advantage.