KANTAR - Grocery price inflation lowest in over a year but financial pressures still weighing on consumers' minds

- Get link

- X

- Other Apps

Grocery price inflation has dropped to its lowest level in over 12 months at 12.2% for the four weeks to 3 September 2023, according to our latest data. Take-home sales from the grocers rose by 7.4% compared with the same period in 2022, a slight increase on the 6.5% growth reported last month.

Grocery price inflation is down for the sixth month in a row but 12.2% won’t be a number to celebrate for many households. Our data shows that 95% of consumers are still worried about the impact of rising grocery prices, matched only by their concern about energy bills.* After a full year of double digit grocery inflation, it’s no surprise that just under a quarter of the population consider themselves to be struggling financially – although this is a very slight drop compared to May.

Discounter growth slows, but still leading the field

The discount retailers have benefited from the inflationary context with knock-on effects for British shopping habits more generally. We’re now marking one year since Aldi became the fourth largest supermarket in Britain and alongside Lidl, it has made some of the biggest market share gains over the past 12 months as consumers continue their hunt for value. This month, Aldi grew sales by 17.1% and Lidl by 16.0%. Between them, the discounters now capture 17.7% of the sector. We expect this performance to continue as inflation remains stubbornly high, however, growth rates for both the discounters have been slowing in recent months as they annualise against rapid rises last year.

One of the big stories of recent times has been the boost in own-label sales which dominate Aldi and Lidl’s shelves. Sales grew again by 9.9% in the latest month and supermarket

Switching wins for grocers as Wilko collapses

Wilko has been the latest casualty of the struggling high street, with all of its stores now set to shut by early October. Shoppers have been making the most of Wilko’s closing sales, with its share of non-food groceries like toiletries, healthcare and household goods jumping from 1.8% in July to 2.3% in August. However, its sales are still down on last year and consumers are going elsewhere. Tesco, Aldi and the bargain stores, such as, Poundland, B&M and Home Bargains, have been the biggest winners of customers switching spend away from Wilko.

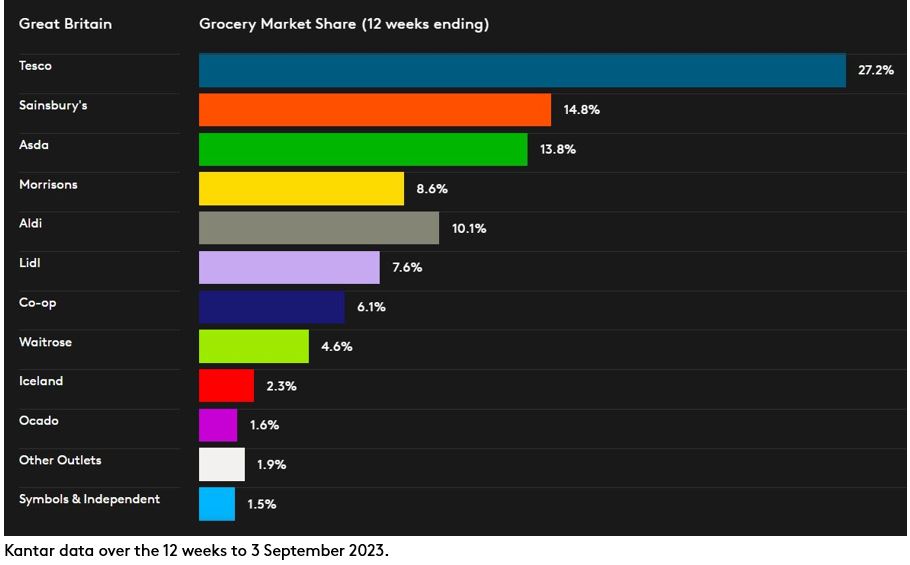

Sainsbury’s and Tesco were the fastest growing traditional retailers this month, growing sales by 9.1% and 9.3% respectively. Tesco’s share now stands at 27.2%, up by 0.3 percentage points from last year, and Sainsbury’s at 14.8%, up by 0.2 percentage points.

Asda’s market share is at 13.8% and Morrisons 8.6%, with sales up by 5.1% and 2.0% respectively. Waitrose’s growth accelerated to 5.6% this month, meaning that the retailer now holds 4.6% of the market. Ocado also saw sales increasing faster than last month, with growth now at 4.3% and market share at 1.6%.

Co-op sales were up by 2.5% versus a year ago with the convenience retailer now holding a 6.1% market share. Iceland’s sales rose by 4.3% to take a share of 2.3%.

*Kantar pressure groups survey, sample = 9,762, fieldwork 52 weeks to 6 August 2023