Slight Easing In Grocery Inflation; Aldi Achieves Double-Digit Market Share

Namnews, 25th April 2023

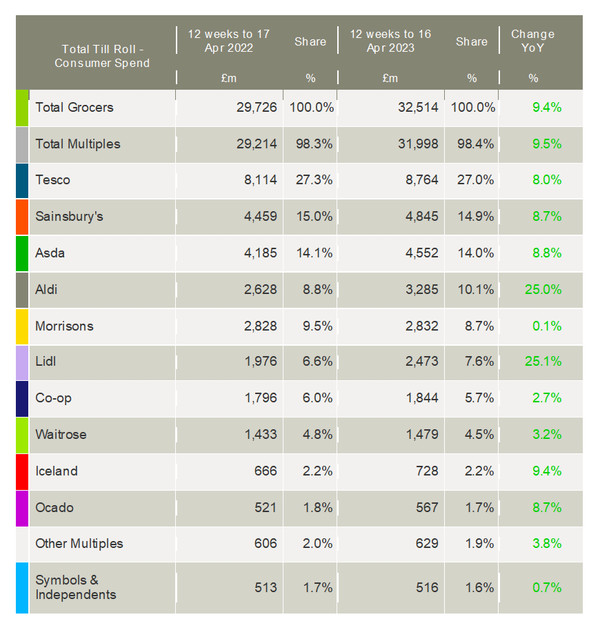

Latest data from Kantar shows average grocery prices rose by 17.3% in the four weeks to 16 April, down marginally on the 17.5% inflation figure recorded in the previous month. However, take-home grocery sales grew by only 8.1% over the period, suggesting a further decline in volumes, with the discounters continuing to outperform the traditional Big Four supermarkets.

“The latest drop in grocery price inflation will be welcome news for shoppers, but it’s too early to call the top,” said Fraser McKevitt, head of retail and consumer insight at Kantar.

“We’ve been here before when the rate fell at the end of 2022, only for it to rise again over the first quarter of this year. We think grocery inflation will come down soon, but that’s because we’ll start to measure it against the high rates seen last year. It’s important to remember, of course, that falling grocery inflation doesn’t mean lower prices, it just means prices aren’t increasing as quickly.”

After ten months of double-digit price growth, consumers are continuing to turn to own-label lines to make savings, with growth of 13.5% this period. The cheapest value own-label lines did even better, with sales climbing 46% versus a year ago. Branded sales are still going up but more slowly at 4.4%.

Amid soaring prices, both Aldi and Lidl hit new record market shares over the latest 12 week period. Lidl was the fastest-growing grocer, with its market share hitting 7.6% after its sales increased by 25.1%.

Meanwhile, Aldi hit double-digit grocery market share for the first time (10.1%) after its sales rose 25.0%.

Kantar noted that consumers are continuing to shop around, visiting at least three major retailers every month on average. McKevitt said: “The discounters have been big beneficiaries of this, with Aldi going past a 10% market share for the first time this month. That’s up from 5% eight years ago in 2015, so we can see just how competitive the market can be. Retailers are really battling it out to show value to shoppers, but if consumers feel their offer isn’t quite right, then they’ll go elsewhere.”

Commenting on reaching the double-digit landmark, Aldi’s UK Chief Executive Giles Hurley said: “Shoppers are voting with their feet by switching from more expensive supermarkets to Aldi. As we hit this new market share milestone, our commitment to offering the lowest grocery prices in Britain is stronger than ever.”

Meanwhile, the three largest grocers continued to grow at similar rates over the 12-week period. Asda led the pack with sales up 8.8% year-on-year, giving the retailer a 14.0% share of the market. Tesco and Sainsbury’s weren’t far behind, with their sales increasing by 8.0% and 8.7%, claiming 27.0% and 14.9% of the sector respectively.

Sales at Morrisons continued to recover but still only grew 0.1%. Recent moves by Waitrose to improve its price competitiveness appear to be paying off, with sales increasing by 3.2% – its best performance since June 2021. Cash-strapped consumers buying more frozen food helped Iceland achieve a growth rate of 9.4% and maintain its market share at 2.2%. Ocado outpaced the overall online market, increasing sales by 8.7%.

Kantar noted that shoppers are likely to be looking ahead to the three bank holidays in May, including for the Coronation, which could impact grocery sales. McKevitt commented: “We’ve recorded bumps in supermarket sales for previous major royal events. During the week of the Platinum Jubilee last year they were £87m higher than the average in 2022. We’ll be keeping a close eye on the data in the weeks to come to see if we get the same effect this time around, including how many of us indulge in a Coronation Quiche. Only half of British households bought a quiche over the past year so it might not be for everyone.”

NAM Implications:

- Step back and think of the impact of 17.3% inflation from the consumer’s POV….

- Then an 8.1% sales increase becomes more understandable.

- And any fall makes little difference.

- In fact, ‘falling grocery inflation doesn’t mean lower prices, it just means prices aren’t increasing as quickly’ – says it all…

- Meanwhile, the cheapest value own-label growing at 46% (i.e. faster than inflation)…

- …coupled with the fact that equivalent brands cannot force thru sufficient CPIs.

- Meaning that the brand premium on these items is less, possibly making it easier to win back switchers?

- However, the big idea has to be the discounters at a combined share of 17.7%, growing at over 25%…

- …3x the rate of the Mults.

- Who can afford not to engage?