Study Finds Cost Of Living Crisis Is Impacting Eco-Shopping Habits

Namnews, 27th September 2022

Kantar has published its Who Cares, Who Does report for 2022, which looks at the connection between consumer sustainability attitudes and their real shopping behaviour.

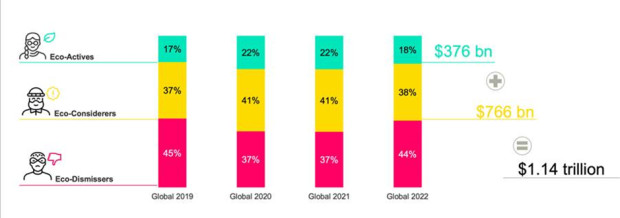

The study, which surveyed almost 100,000 shoppers in 24 countries, finds that, for the first time in the report’s four-year history, the number of ‘Eco Actives’ shoppers has declined. Eco-actives, those most engaged in sustainability issues, dropped by 4% in 2022 compared to 2021 and 2020 – while ‘Eco Dismissers’ rose by 7% to 44% of the global population.

The Eco-actives decline is widespread, with the largest drops seen in Spain (-8%), Portugal (-5%), Ireland (-5%) and India (-5%). More positively, France, the US, and Colombia experienced flat or growing Eco Active groups.

Despite the overall fall, the report notes that Eco Actives shopping power is still worth $376bn to the FMCG market. The segment is forecast to grow to $763bn by 2027 in a pessimistic scenario or to $1.12trn in an optimistic prognosis. The broader population that has at least some interests in sustainability globally is equal to $1.14trn in spending in 2022.

The Who Cares Who Does study segments households into three categories based on their actual behaviours:

- Eco Actives: Shoppers who are highly concerned about the environment and are making the most of actions to reduce their waste.

- Eco Considerers: Shoppers worried about the environment and plastic waste but are not taking many actions to reduce their waste.

- Eco Dismissers: Shoppers who have little or no interest in the environment and are making no steps to reduce waste.

Environmental attitudes segmentation of global households

Source: Kantar & GfK

The report notes that the cost of living crisis is having an environmental impact. Almost one-half (45%) of respondents reported that it was harder to act sustainably due to social or financial constraints.

Recent findings from Kantar’s Sustainability Sector Index study revealed that the cost of living means sustainability is becoming a luxury of wealthy consumers. The WCWD study reinforces this point. In the UK, for example, the top 20 brands that outperform with Eco Actives are, on average, 75% more expensive than the average price in their category. However, given the financial headwinds, Kantar says this positioning may face challenges. Within the total FMCG market, brands with price points more than 10% over the category average are already experiencing share declines.

Meanwhile, when it comes to consumer behaviour around packaging, there is a large value-action gap – between people’s stated values and their actions. 62% of people try to buy products with environmentally friendly packaging. Only 24% however, regularly avoid buying products packaged with plastic. These unfulfilled good intentions mean there is a market opportunity for brands in helping shoppers to close this gap. Kantar states that closing this value-action gap represents a $991bn opportunity for those FMCG companies willing to pursue stronger environmental credentials.

Natalie Babbage, Global Director for Kantar’s LinkQ Solution, commented: “Amidst a difficult world climate – from conflict and political instability, to spiralling costs and inflation, environmental issues have dropped down the priority list for many people in their day-to-day worries. It is unsurprising that against these very prominent and present issues, sustainability and its more long-term negative effects are not being prioritised.

“The post-pandemic era has had a life-changing effect. As lifestyles have got busier, with more people back at work and social lives back on track, people don’t have the time they may have had during government and state-enforced lockdowns. This means a return to seeking convenience over plastic-free items: we see people buying fewer refills, avoiding plastic less and buying plastic drink bottles more, which may all be symptoms of this ‘back to normal’, time-poor lifestyle we experienced pre-Covid.

“Frustration at lack of progress from companies also appears to be a factor for shoppers. Eco Actives a group that thrives on optimism, yet we found that there is cynicism among them regarding how far brands are going, and how much brands truly care about the environment.”

NAM Implications:

- When alligators are snapping…

- …it can be difficult to remember to drain the swamp.

- i.e. as times get tougher…

- …sustainability becomes more of a luxury and ’nice to have’.

- Pragmatists will hunker down and focus on deliverable business…

- …and staying alive.