Grocery Shoppers In Ireland Spending More On Premium Own Label And Moving Online

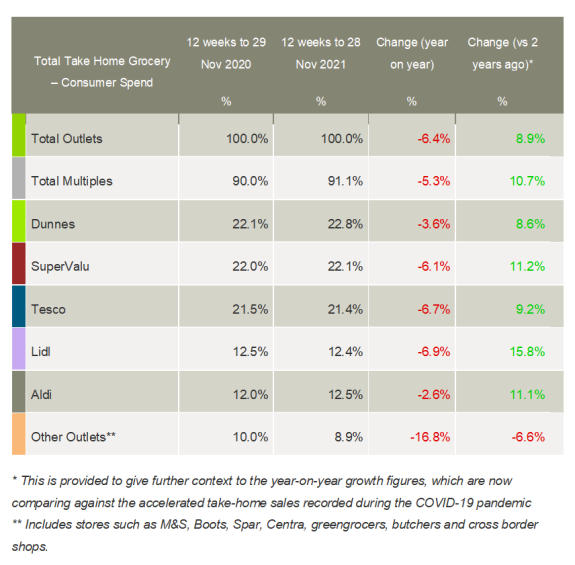

The grocery sector in Ireland saw sales decline by 6.4% over the 12 weeks to 28 November. However, the market share data from Kantar shows growth remains strong compared with pre-pandemic times, up 8.9% versus the same period in 2019.

Emer Healy, retail analyst at Kantar, commented: “It’s important to remember that grocery sales are now being compared with last November when non-essential shops and offices were closed. But life in the latest four weeks has been very different to this time last year as the hospitality sector is open and many people are working in the office for at least part of the week. We have been buying less for meals at home and as a result, grocery sales dropped by 7.1% during the past month.

“However, with new restrictions in place again from early December, we expect to see this decline soften as people spend more time around their kitchen tables in the coming weeks.”

The excitement over Christmas has been slightly dampened this year with the news of the Omicron variant and concern over rising inflation. Healy continued: “Grocery price inflation stands at 1.2% over the latest 12 weeks as prices have been put under pressure by a series of supply chain issues complicated by Brexit and the pandemic.

“Shoppers will inevitably feel the impact on their Christmas budgets this year and we’re already seeing prices for some festive staples nudge up. The price of a Christmas meal for four now stands at €30.97, which is 4.3% higher than it was last year.”

Despite higher prices, the data suggests that shoppers are still eager to make up for last year’s disappointment and will be treating themselves after a tough 2021. Premium own-label sales rose by 2.4% over the latest 12 weeks, and Kantar is predicting record-breaking demand this year.

Online grocery sales also received a boost. More than one in ten people purchased groceries online this month, and as a result, digital grocery sales soared by 14.3% over the past four weeks. Healy said: “First-time online grocery converts were the main driver behind the jump in sales, showing the channel is yet to hit its ceiling in Ireland. We could see online orders grow even further as people start to limit time spent out of their homes under the latest restrictions.”

Both SuperValu and Tesco have heavily invested in growing their digital capabilities since the start of the pandemic and achieved particular success through the channel this month, with online sales up by 8.8% and 11.4%, respectively. SuperValu holds a 22.1% share of the overall market this period, while Tesco’s share stands at 21.4%.

Healy commented: “While all of the major grocers achieved growth compared with two years ago, tough comparisons against the high sales of 2020 meant year-on-year grocery spend was down across the market. Various lockdowns have shifted the goalposts in terms of how and where people shop, and it will be interesting to see how new restrictions impact consumer behaviour over the festive period.”

Dunnes holds the biggest share of the market this period at 22.8%. The grocer benefited from the biggest influx of new shoppers among all the retailers, a trend which added €34.6m to its overall performance.

Meanwhile, Aldi increased its share to 12.5%, with Lidl just behind on 12.4%.