Supermarket Sales Falls As Shoppers Rebalance Spending; Promotions Down Amid Availability Concerns

Total till grocery sales in the UK fell 0.7% in the four weeks to 9 October due to tough comparatives and shoppers beginning to rebalance their spending habits amid growing concerns around rising energy and fuel costs.

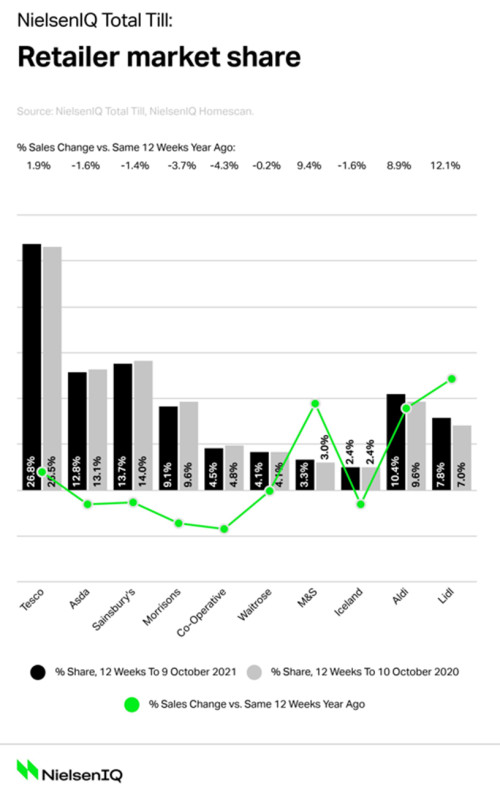

The data from NielsenIQ revealed UK shoppers spent £11.8bn on groceries during the month, which is £41m less than the same period last year. However, this is still up 6.6% compared with pre-pandemic shopping two years ago. In terms of retailer performance over the last 12 weeks, Lidl (12.1%) and Aldi (8.9%) continued to grow sales as consumers opted for more value-based options. Tesco (1.9%) and Marks & Spencer (9.4%) were the only retailers to gain market share outside of the discounters.

NielsenIQ highlighted that spend on promotional items remained low at 20%, down from 22% during the same period last year amid growing concerns around availability issues and disruption in the supply chain. Households are also being encouraged to shop earlier ahead of the festive period – meaning they are not waiting for the start of seasonal promotions.

As well as a rebalancing of basket spend, consumers appear to be shifting their shopping habits towards an omnichannel experience akin to non-grocery retail shopping behaviours. The NielsenIQ data reveals that shoppers are now moving fluidly across digital and physical channels when doing grocery shopping, as both visits to stores (+5.5%) and online shopping trips (+5.3%) increased over the last four weeks.

As online shopping becomes part of consumers’ grocery shopping routines, NielsenIQ Ecommerce Benchmark data has identified an evolution in how consumers in the UK are shopping for groceries online compared to a year ago. The share of sales of 12.6% is down only slightly from 12.9% a year ago, but over 1 in 4 shoppers continue to buy groceries online every 4 weeks and they are now shopping online more often, but with smaller basket sizes. This has allowed shoppers to purchase more convenience items online, with sales of fresh pizza (+17%), mineral water (+17%), freshly prepared salads (+11%) and cakes (+10%) all rising within the last 12 week period. This suggests a growing consumer trust in the quality and range of products that are available online.

Looking ahead, Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight, suggested that October will be a tipping point for food retail spending.

He said: “This is down to a plethora of factors, including cautious consumer sentiment, increased concerns about discretionary spend, and ambient food inflation – which accelerated to 0.8% in September and also ‘lockdown 2’ comparatives starting in November. This is likely to be reflected in top-line growth continuing in the region of -1% to +1%.

“These trends will also give added momentum to value-based retailing – with shoppers looking to spend less but still get good value for money. As a result, supermarkets may rely less on broad promotions and instead focus on driving loyalty via smart targeting of discounts and personalised price cuts, such as Tesco Clubcard and Nectar prices and if needed, the return of vouchering.”

Watkins concluded: “We also cannot ignore that availability issues are still top of mind with shoppers, with news headlines questioning whether shelves will be stocked this Christmas. Should some shoppers choose to forward purchase seasonal food and drink, for example purchasing one or two extra items on every visit, this may be enough to help keep growth positive. Large out of town stores could also benefit this year should shoppers decide to buy non-food such as toys, gifts and homewares.”