Retail Sales Return To Growth; Consumer Confidence Hits Pre-Pandemic Levels

Retail sales in the UK resumed their post-lockdown recovery in June after a surprise fall in May.

With a boost from food and drink shopping for the Euro 2020 football championship, sales volumes increased by 0.5% month-on-month and were up 9.5% when compared with pre-pandemic levels in February 2020.

The largest contribution to growth in June was from food shops where sales rose by 4.2% as consumers stocked up on snacks and booze to watch the games. Supermarket sales had dropped in May as shoppers chose to eat out after some Covid restrictions were lifted in the hospitality sector.

However, non-food stores reported a month-on-month decline of 1.7%, driven by falls in furniture and clothing stores.

People continued to shop online more compared to before the pandemic. However, the amount they spent fell by 4.7% and the overall proportion of retail spending online slipped to 26.7% from 28.4% in May – the fourth consecutive monthly fall.

The total retail sales figure was better than expected and Aled Patchett, head of retail and consumer goods at Lloyds Bank, said retailers will be hoping June marked the start of the turnaround they have been hoping for.

He added: “All eyes now are on the impact of the gradual unlocking of society across the UK. On the surface, the easing of restrictions and commuters returning back to city centre offices should be good news for the sector, but workers having to self-isolate means many businesses are reporting a shortage of staff just as demand looks likely to peak.”

Meanwhile, separate data released today suggests that consumer confidence has risen to pre-pandemic levels.

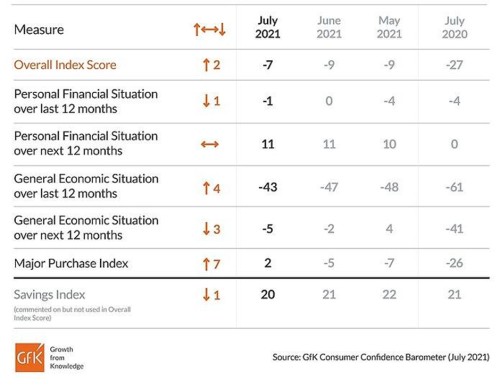

GfK’s long-running Consumer Confidence Index rose by two points to -7 this month, with people more optimistic about their personal finances and confident in making major purchases.

“Consumer confidence edged ahead of its March 2020 pre-lockdown headline score by two points in July and has held firm or improved for six months in a row,” said GfK client strategy director Joe Staton.

“Personal finance expectations for the next year remain strong and there’s a dramatic jump this month in our major purchase sub-measure with shoppers agreeing that now is the ‘right time to buy’.

“The healthy seven-point rise aligns with strong retail growth figures that reflect the gradual unlocking of the UK high street and release of pent-up demand as Brits hit shops, restaurants and venues.”

However, GfK suggested that threats from increasing consumer price inflation, rising Covid infection rates, and the end of the furlough scheme could result in the rebound stalling.

“Consumers are aware of these pressures judging from the latest fall – from -2 to -5 – in how they view the general economy in the year ahead,” said Staton.

“What happens across the remaining summer months will frame consumer confidence for the rest of 2021 and beyond.”

NAM Implications:

- ‘Pent-up demand as Brits hit shops, restaurants and venues’

- …has to be diluted by anxieties re job security and obsession with health.

- Apart from many emerging as super-savvy consumers…

- …unwilling to settle for anything less than demonstrable value for money.

- Watch this space, with caution…