UK coffee shop sector 2021: recovering from COVID and meeting new shopper needs

The coffee shop market has seen significant changes over the past year, with specialists severely impacted by lockdowns and site closures.

In 2020, 59.5% of sales were lost and coffee specialists’ share of the food-to-go market decreased by 5.1%. However, recovery has begun and by 2022 the market is set to grow to £2.8bn – a 115% increase from 2020, although this will still be 15% less than in 2019.

Source: IGD UK coffee shop sector report 2021

In our latest report on the coffee shop sector and its shoppers, we look at the operations and shopper profiles of the three biggest players – Costa, Starbucks and Caffè Nero – and the new entrants who may disrupt the market.

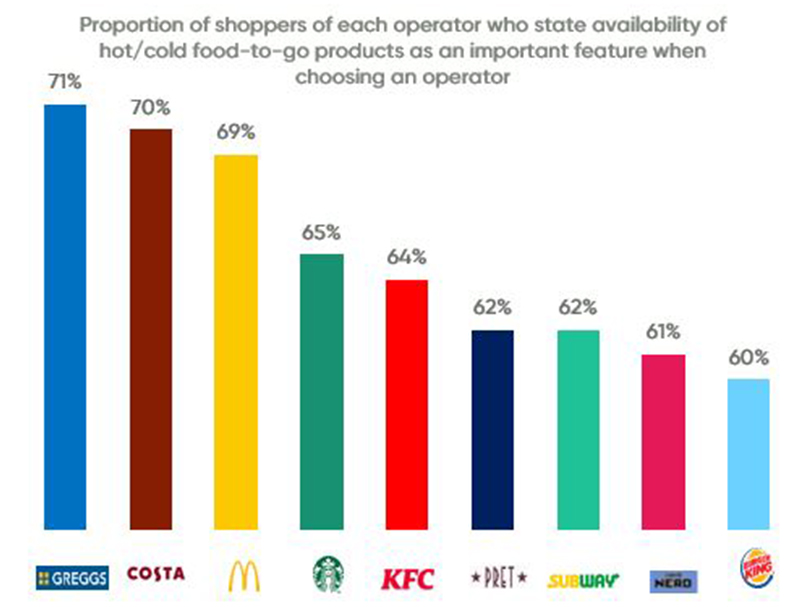

Food ranges and availability are a top priority for shoppers

Source: IGD The Coffee Shop Shopper Report, June 2021

Challenges and opportunities

In trying to retain customers, technological opportunities, such as app development will help brands to re-engage customers and improve loyalty.

Competition intensifying

Source: IGD Research

Key trends shaping the market

The key trends which we see shaping coffee specialists in 2021 include:

- Sustainability

- Diverse formats

- Menu development

- Loyalty

- Digital

- Retail

- Brand experience

Where can coffee specialists look for inspiration?

The rising stars in the UK coffee specialist market which pose a threat to the major players include: Bewiched Coffee, WatchHouse, Paddy and Scott’s, and Caffe Carluccio’s. Some of these brands are new to the market and their concepts have the potential to disrupt the market – larger specialists will need to pay attention to their operations.

Source: Crown Coffee