Grocery Sales Remain Resilient; M&S And Discounters Performing Well

Data released today by NielsenIQ shows total till grocery sales at supermarkets in the UK fell only 2.4% in the four weeks to 19 June despite facing tough comparatives with the exceptionally high levels of spending in the sector last year.

A late May bank holiday weekend, combined with a short heatwave and the beginning of Euro 2020 all helped to maintain grocery sales, which remained flat (-0.1%) over the longer 12 week period.

NielsenIQ’s data also confirms that category performance shifted in response to changes in weather. For example, delicatessen sales grew 13.5%, with soft drinks (+12.3%), bakery (+8.7%) and crisps, snacks and nuts (+4.1%) all increasing as shoppers sought to enjoy the sunny period. This is in contrast to sales for frozen (-9.3%) and packaged grocery (-12.8%), whilst spend also shifted away from beers, wines and spirits (-4.4%) as indoor drinking and eating returned.

Meanwhile, NielsenIQ found that online grocery sales declined by 6.9% over the last four weeks. However, 8 million shoppers – equal to 28% of all households – continue to shop online every four weeks, indicating that this is a ‘sticky’ habit, likely to remain at a much higher level than before even as the country emerges from restrictions. Online share of FMCG sales is currently 13.1%.

The data also confirms that some pre-covid shopping behaviours are beginning to be re-established, with shoppers continuing to visit stores more often, up 15% compared to this time last year. As a result, the average spend per visit has reduced by 15% to £17.2 from £20.4 a year ago.

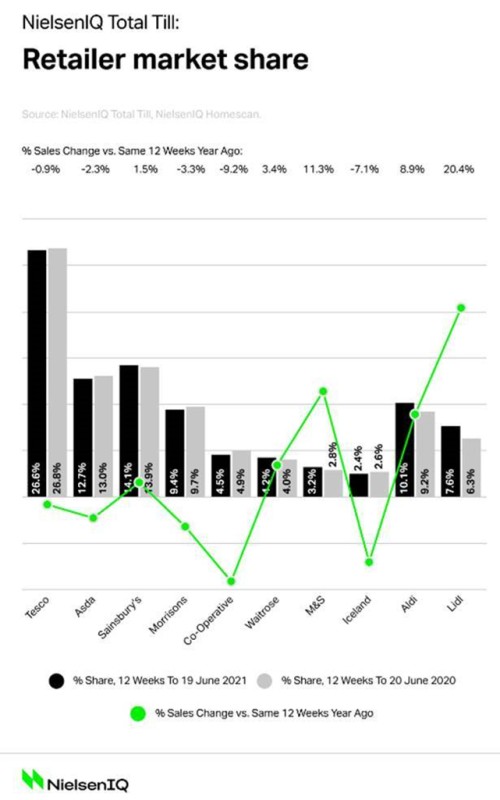

Over the 12 weeks period, food sales at M&S increased 11.3% as the retailer’s range overhaul continued to pay dividends. Growth was also strong at the discounters but this was partly driven by new store openings, particularly in the case of Lidl where sales increased 20.4%.

Sainsbury’s was the only grocer of the Big Four that grew market share in the last 12 weeks. Sales for the Co-op and Iceland remained in decline as a result of tough Covid-19 comparatives, but the increase in visits to these retailers continued to mirror the market.

“With some lockdown restrictions still in place, British consumers have maintained spend at UK supermarkets, with sales remaining relatively buoyant over the last four week period against the high spend during the lockdown last year,” said Mike Watkins, NielsenIQ’s UK Head of Retailer and Business Insight.

“Staycations for most families this year and the anticipated relaxation of remaining restrictions in July, are expected to be catalysts to a change in retail spend. Whilst more food spend will shift back to hospitality, the increase in seasonal travel and families and friends finally able to join together without restrictions, will give an added boost to food and drink categories at supermarkets.”

NAM Implications:

- Business as usual i.e no surprises here.

- Except: Aldi have overtaken Morrisons again this month…