What does foodservice reopening mean for UK retail?

This year, with the government's reopening roadmap on track, the big question for retailers is “what will be the impact of foodservice reopening?”

In our latest Eating In vs Dining Out report, in collaboration with foodservice consultant Peter Backman, we forecast the size of the UK food and drink market in 2021 and examine how retail and foodservice shares will evolve.

The report also looks at what will drive foodservice recovery, and what this means for retail, with a quarter-by-quarter analysis to help business in both sectors plan for the year ahead.

Here’s a summary of our findings. Retail Analysis subscribers can read the full report here.

Foodservice and retail will both grow in 2021

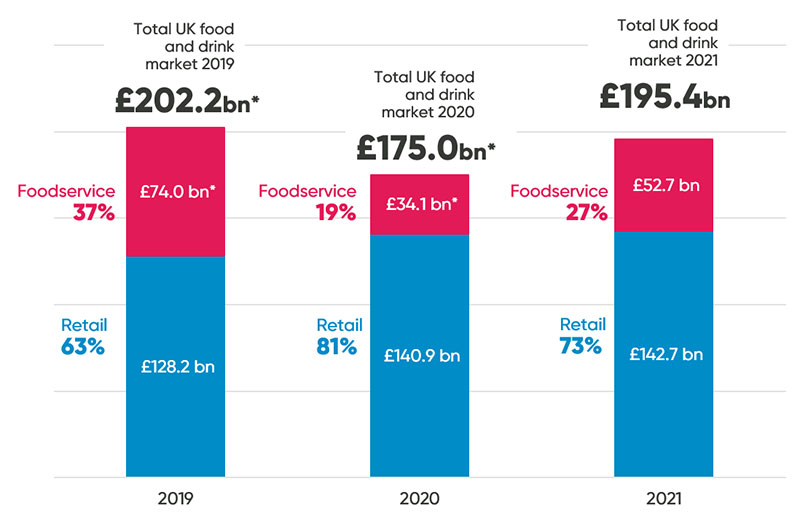

2021 UK food and drink market forecast

Source: IGD research, Peter Backman *Foodservice 2019 and 2020 revised as more detailed information became available, UK food and drink market totals revised accordingly

With more social occasions in- and out-of-home, UK consumers will be spending more on food and drink this year than they did last year, causing the market to grow in both foodservice and retail.

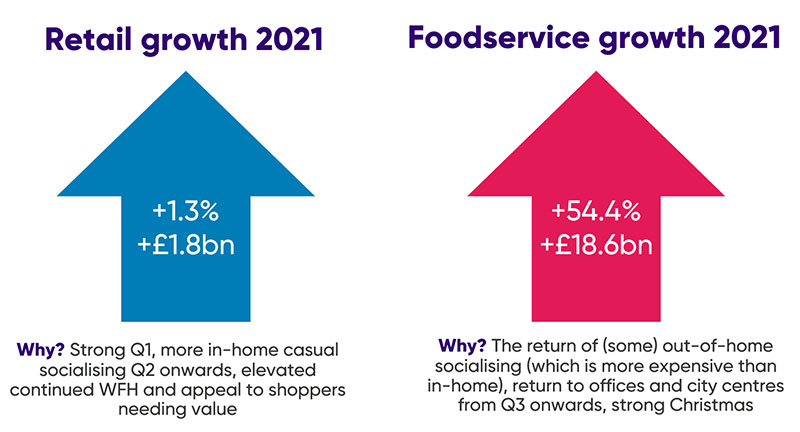

Returning consumer confidence following rapid vaccine rollout, will boost foodservice by 54% to £52.7bn in 2021, reaching 71% of 2019 levels.

A strong Q1 and more in-home casual socialising will help retail grow at 1.3% vs the tough comparatives of 2020 to £142.7bn

Overall, the UK food and drink market will grow by 12% in 2021 vs 2020 to reach 97% of its 2019 pre-COVID value.

The split of food and drink sales of roughly 1/3 foodservice to 2/3 retail seen in 2019 will not return in 2021, with foodservice claiming around 1/4 of the market this year.

What will drive growth in both sectors?

Source: IGD research, Peter Backman

During the pandemic, a significant number of people report that their financial position has been weakened by COVID. This applies especially to households that were already badly off. However, a small minority have seen their wealth increase. This might be people who have managed to build up savings during the last year

The dynamics of this ‘K-shaped recovery’ are important to understand as some consumers will need to prioritise value whilst others may be looking to treat themselves (ShopperVista subscribers can read more about the impact of the K-shaped recovery on shoppers here).

To achieve growth this year, unlocking “accidental savings” accrued by some people during the pandemic will be important for both retail and foodservice. At the other end of the spectrum, retailers and operators need to consider how they can appeal to increasing numbers of people searching for value.

Outlook for the year

This quarter (Q2) will be a transitional period for the food and drink market as restrictions ease gradually and businesses, particularly in the foodservice sector, still benefit from government support.

In Q3, post-COVID in- and out-of-home consumption patterns will start to emerge. This could be a very difficult time, particularly for foodservice, as sales grow but so does cash outflow. During this time financial supports for operators are withdrawn and debts to landlords, government, trade and other creditors fall due. Staycationers and an increase in returning office workers offer opportunities for both foodservice and retail. Good weather could also boost in- and out-of-home socialising.

Assuming any new pandemic wave is manageable, the year could finish on a high for foodservice as people celebrate a release from COVID restrictions and make up for a lack of festive social events last year. Halloween is likely to boost retail sales but Christmas could be mixed with some loss of last year’s sales to hospitality but also bigger (and more luxurious) family gatherings at home.

Want to know more about the future of UK foodservice and retail?

- Eating In vs Dining Out: what does foodservice reopening mean for retail? Read the full report

- UK food-to-go market forecast: Q1 2021 update An update to our food-to-go predictions for the UK market 2020-2022 considering the latest developments and shopper responses to COVID-19. This report includes sections on mobility, working from home and new initiatives from around the world.

- UK Country Presentation This in-depth guide explores the key trends in grocery retail and the growth strategies of major retailers as they respond to the Covid-19 crisis and prepare for EU Exit. It also includes our current market and channel forecasts, as well as quarterly LFL and full year profit data for The Big Four retailers.