Supermarkets Prioritising New And Disruptive Brands

Vegan products are set to dominate UK shopper baskets in 2021, but supermarkets are expected to prioritise new and disruptive brands in this category. Meanwhile, listings for low alcohol products at supermarkets increased by 30% in the last 12 months, sparking an upwards trend in healthy alternatives in the new year.

This according to data from analysts at Edge by Ascential’s e-commerce analytics SaaS platform, Digital Shelf. They revealed that in 2020, chilled and frozen vegetarian and vegan ranges experienced modest growth of 3% as supermarkets sought to keep their ranges lean amid the pandemic.

However, growth in the category was primarily led by smaller manufacturers and new disruptors, with 15% more brands available to shoppers in the category than in November last year.

Meat-free brand Naked Glory, launched in 2019, has seen the most growth, increasing ranges across several major UK supermarkets by 200%, followed by Squeaky Bean (+166.7%) and The Tofoo Company (+50%). This is at the expense of more established brands like Quorn, which saw a substantial 30% decrease in listings across the big four supermarkets over the last 12 months, as did Linda McCartney (-3%).

Growth in disruptive vegan brands

The chocolate bar category was also disrupted by several new vegan entrants to the market. Edge by Ascential revealed that vegan chocolate ranges in UK supermarkets have almost doubled, growing their share of shelf in the chocolate category from 3.6% to 7% in the last 12 months.

This was driven by vegan chocolate brands like Nomo (No Missing Out), which had over 80% more listings in the last 12 months. Analysts anticipate significant growth in this category in 2021 as big brands like Lindt enter the market with oat milk-based formulas.

Meanwhile, the Edge by Ascential data shows that sales of low and non-alcoholic drinks grew by 30% in supermarkets during the first national lockdown. Similar to the trends in the vegan category, established brands are beginning to lose share of shelf to new entrants, particularly in the spirits category. This includes smaller brands such as Stryk and Aecorn, which have grown a little bit more in the past year. This has therefore taken away some share of shelf from brands such as Seedlip and Ceder’s, which both had a combined 63% share of the category in October 2019. However, a year later this has reduced to 45%.

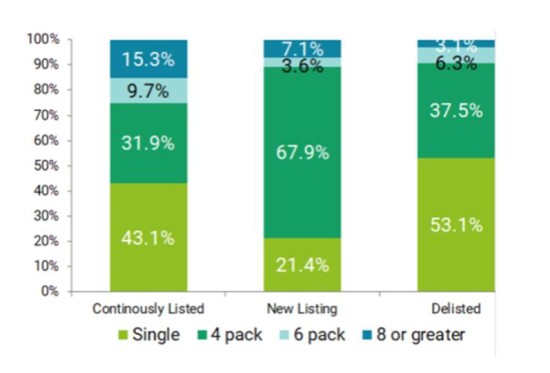

The increased demand in online shopping is also driving manufacturers to rethink their package sizes, with 53% of all delistings in the craft and beer category being single bottles, whilst 67.9% of new listings were for four-packs.

E-commerce influencing format changes in the beer category

in the last 12 months

Chris Elliott, Digital Shelf Analyst at Edge by Ascential said: “2020 has been a challenging year for grocery retailers who have had to cut back on ranges as the pandemic forced retailers to focus on stocking essential goods. However, it’s interesting to see that retailers have still focussed on introducing new and disruptive brands, particularly in the plant-based and low alcohol categories.

“Looking ahead to 2021 we expect to see an acceleration of this trend led by these categories. This could be in the form of product exclusives as retailers seek to differentiate their propositions, whilst also reigniting inspiration among consumers with new and exciting product lines. The sudden shift to online shopping has also led retailers to rethink their formats, especially in categories such as alcohol in which pack sizes have dominated over single bottles. As we continue to navigate the ‘new normal’ in post-pandemic Britain, this could also suggest a more permanent change in more formats in the new year.”

NAM Implications:

- Great opportunity for brands that can afford to innovate and disrupt.

- But worth keeping in mind that traditional brands are unlikely to await developments…

- …and see share slip away.

- 2021 has to see some innovative approaches by each side…

- …and no one can afford to sit on the side-lines.