Food & Grocery Market To Grow 10% By 2022, Led By Online And Discount Channels

20th August 2020, Namnews

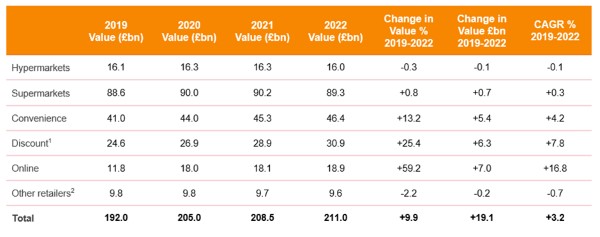

The food and grocery market in the UK is set to grow by 10% – or by £19.1bn to £211bn – between 2019 and 2022, with the pandemic accelerating change in the industry.

This is according to a new report from IGD which examines the potential impact of COVID-19 on the overall market during the next three years, with a breakdown of expected implications and performance on individual channels.

As widely reported, the pandemic has accelerated the shift to online, with IGD expecting the channel to retain the loyalty of new shoppers in the longer term. However, discount is predicted to become the fastest-growing channel in 2021 and 2022 as shoppers look to economise due to rising unemployment.

Following recent dramatic increases in shopper numbers and bigger order sizes, online will be the fastest-growing channel in 2020 with it overtaking hypermarkets in value terms (see table below). IGD is forecasting value growth of 59.2% (£7bn) over the period to 2022 with online’s share of the market increasing from 6.2% to 8.9%.

Simon Wainwright, Director of Global Insight at IGD, commented: “We forecast e-commerce will gain market share faster than previously predicted, following the dramatic influx of new shoppers and bigger order sizes in 2020 as a result of COVID-19. While we expect growth to pause in 2021, it will later resume, with continuing expansion from Amazon and the launch of online operations by M&S through Ocado supplementing activity by the Big Four.”

Meanwhile, the market share of the discount channel is expected to increase from 12.8% to 14.6% in 2022 after seeing value growth of 25.4% (£6.3bn).

Wainwright said: “Though eclipsed by the surge in online sales in 2020, discount will be the fastest-growing channel in 2021 and 2022 as unemployment climbs and shoppers across the income spectrum look to economise. Store network expansion will enable this growth, with smaller store formats enabling Aldi and Lidl to boost their reach into urban areas and some variety discounters (e.g. B&M and Home Bargains) scaling up their grocery operations.”

After proving popular during lockdown, the convenience channel is also set for robust growth (+13.2%) over the three-year period with further market share gains (21.4% in 2019 to 22% in 2022).

Wainwright commented: “Having benefited significantly from meeting local needs during lockdown, growth for convenience stores will slow in 2021 and 2022. There is a key opportunity for stores that develop their role as destinations for local community needs going forward, but the slow recovery of trading in city centres and transient locations is likely to affect overall channel performance.”

Having benefitted from consumer stockpiling at the start of the pandemic, IGD sees traditional supermarkets and hypermarkets returning to longer-term trends. The market share of hypermarkets is expected to decrease from 8.4% to 7.6% in 2022 and the share of supermarkets is forecast to decline from 46.1% to 42.3%.

Wainwright concluded: “Strong growth at the start of the pandemic – driven by shoppers stocking up and preferring spacious stores – has receded. We expect hypermarkets to revert to sales declines as more shoppers migrate to other channels. After a boost to sales in 2020 from COVID-19, supermarket growth will turn negative by 2022. The channel will lose ground, particularly to discount and online, though it will defend its share better than hypermarkets.

“Retaining the loyalty of shoppers who switched to them at the start of the pandemic will be the priority for operators of large stores. Making stores easier to shop while also differentiating through their range and emphasising value will be vital as stores pivot towards more functional retailing.”